Providers that use an external billing company likely are keeping a close eye on their collection rates and auditing to ensure the external billing company is doing a good job.

However, when not using an external billing company but rather doing it internally, it is often the case that the provider is not monitoring and auditing their own internal billers’ results and collection success. Typically there is a higher level of trust that the job is done correctly by internal billers. Often, the issue is that the internal team is doing their best to collect and they are worthy of that trust, but they lack the tools or resources to do the required tasks as well as they need to be done. The rapid changes in the industry such as added complexity from insurance; new laws for billing patients; changes in technology; and increases in patient calls for assistance, all make the billing process even more difficult for internal departments.

The billing process entails many tasks that could be more efficiently done by an external billing group where each department specializes in areas of expertise To increase efficiency for tasks like Billing, Denials, Follow-ups, Appeals, Patient calls, Cash Posting, etc. requires specialized focus and skills for that unique task. Jumping from one task to another as required of internal teams can reduce efficiency and hinder collections success. Using internal billing often requires a person to be a jack-of-all-trades but only a master of some.

Despite reasonable efforts, the process internally could be leaving behind the last 10-15% of collections, or possibly leaving tasks like patient calls and emails unanswered for an extended period simply due to the need for resources to be focused on the one task currently prioritized.

Some elementary reports/audits can be performed internally; producing this information should take minutes.

Below are some suggested reports and processes to review to determine if you are doing the same quality job that a well-run professional billing service would be doing for you.

What are some simple steps one should take to audit internal billing collections?

Here are some simple reports to start with to ensure you are getting the correct percentage of claims paid and providing the best service to your patients from a billing perspective. If your billing is truly tracking all claims results, this information should be accessible in minutes.

1) Are claims with insurance getting left behind due to lack of follow up, or denials and appeals not being handled?

A report to check on this is one that lists all runs in the previous calendar or fiscal year (all claims older than 4-6 months) that had insurance and no payment was received. The report should not list only claims with a balance, as zero balance claims could have been written off or sent to Bad Debt. Aging reports often only list open claims. But were those closed claims paid? The report should list all runs in 12 months with Insurance that no one ever paid at least $100 or more. Insurance claims should be paid except for commercial high deductibles—the more on the list, the more possibility of an issue. Insurance claims left behind are an indication of problems with the billing and follow up to unpaid claims.

2) As a secondary concern to the above, a similar report would provide a list of all runs without insurance. That number should be very low also. Many of these end up unpaid or in collections. If possible with your “sent to collections report” can you track how often does the collection company find the insurance you should have found internally?

3) Both of the above affect total collections and reduce the average per-run collection rate.

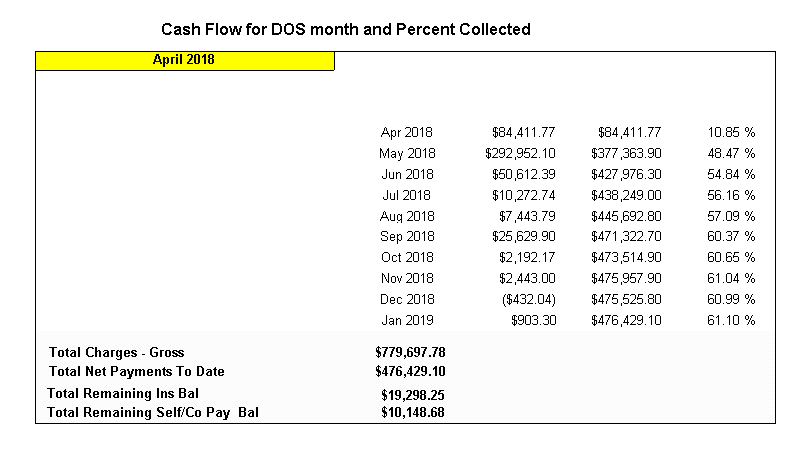

Two other reports, when compared side by side, indicate issues with internal billing. First, use a closed fiscal or calendar year of more than six months ago (if June 2024, use Jan through Dec 2023) which reports on Total Runs that were Billable and Total collected for those runs. (Not cash collected in the year but cash collected for those runs. This is gross for all runs. For that period, if the total collected for those runs is $1,500,000 and you did 3333 billable runs – Your average collection is $450 per run.

Now, take that same report but only include runs where you collected something above zero or a small amount, such as $100. For example, that report shows $1,500,000 collected but only 2750 runs. Your collection per run is $1,500,000 / 2750 = $545.45. This large variance indicates too many runs need to be collected. The total amount varies based on your demographics, specifically Medicare and Medicaid versus Commercial. Also, if the number of patients who have no insurance is high, this report will be worse. However, based on the local demographics, the variance should be 3-4% for private companies (no payments percent of total runs) and more in the 10-15% for Public. When auditing internal billing, we often find that 20-25% of claims are unpaid. That is a lot of Unpaid claims. This report needs some analysis of your demographic area and a review of unpaid self-pay with high deductibles. It should still be a report your internal department can produce, or you are flying blind in terms of really understanding your collections.

4) Are you getting the bills out promptly? Cash flow is more of a private company issue than a public one; however, the speed with which bills are processed is essential. If you collect $250,000 a month and your bills go out in 7 days or 14 days, that is $75,000-$150,000. That should be in your bank, but it is not. Easy checkup. Look at the group of bills being sent out this week. When was the transport performed? If the Date of service is July 6th and you send the initial bill on the 7th or 8th. All good. If you sent it on the 15th or 20th, that is a lot of cash not in your bank account.

Other simple audits of internal billing.

Do you know how quickly your patient calls are answered and how quickly they get a response? If they leave a voicemail, how quickly is that call returned? Are the patients happy with the response, and do they feel important? Does your staff have time to spend as much time as the patient needs?

How easily can your financial departments and auditors get the reports they need?

Is all this tracking information easily visible for the management, dashboards, or reports that ensure your collections are what they should be? This should be different from simply identifying that what we always collected is still being collected. The reason is that collections might have been low for years and the report just perpetuates the problems as normal.

Lastly, are you tracking or auditing your CMS and HIPAA compliance? Proper Medical necessity, the proper level of services, and signatures and documentation supporting all this?

Summary

Everyone knows the only way the billing process results in the highest level of collections is when the last 10 to 15% of the revenue in ambulance billing is collected. This last 10-15% is the hardest to collect. It often requires as much work as the first 85 to 90% of revenue collected. There are many reasons for this, but it usually boils down to the simple fact that denied claims, claims without proper insurance, claims without the right member IDs, claims that are complex to collect from payers, and other variances from the norm create an enormous amount of work. This work is the last thing to do daily for internal billing teams, especially if no specific department handles these tasks. External billing teams have entire departments dedicated just to the problem claims.

Internal teams often have the main priority of getting bills out the door, processing claims, and entering data. Handling patient calls, appeals, denials, finding insurance and other day-to-day items often does not get enough attention from internal billing teams.

The above simple audits and reports can identify if that is a potential problem.

Cost of internal Billing

A future blog will address the actual costs of internal billing in more detail. In discussions with public finance or private management, they often need more information about billing to understand the internal billing costs fully. They usually discuss only personnel costs when so much more is the other expenses.

Here is the list, which we will break down in more detail in a future blog post. Some larger ones are checked:

✔️Salaries – Taxes and Benefits – Per Employee (Varies by region)

✔️Postage costs for mailing invoices and monthly statements (if external printing cost and postage)

✔️Billing software costs

✔️Clearinghouse costs for claims sending and Eligibility Checking

✔️Collection agency costs – especially if claims that should have been collected are sent to them.

Costs for Letters (Insurance needed, Signature Missing)

Obtaining Face Sheets from Hospitals missing

Cost for 1500s forms

Costs Envelopes

Costs for the Printing and printers

Costs for Computers, furniture, and office space

Costs for incoming Patient call if to an 800 Number

Costs for outgoings Phone Costs

Costs for the Appeals processing costs

Costs for Attorney request for documents

Cost to find insurance if missing

Cost to Certify employees (Certified coders, Compliance and Privacy Certification, HIPAA training and other conferences and training)